Wind Turbine Illness + Madoff & Ponzi Schemes + Post-Mortem Nail Growth Myth

Is there any legitimacy to wind turbine syndrome?

There are wind turbines in plenty of places now, and people are starting to complain how it effects their health, but does it really effect their health?

The symptoms include trouble sleeping, headaches, buzzing at the ears, dizziness, vertigo, nauseous, irritability, problems with concentration and memory, and many more.

It's probably just a nocebo effect, the people who keeps thinking that it's effected by the wind turbines and thinking that it causes these kind of symptoms, then they will show those kinds of symptoms.

This is probably similar to the popular disease causing power lines. In the 80s, many many people complain about the power lines and how it's making them sick when there's no evidence whatsoever that it effects the people at all. Now, that trend faded, and people are complaining and claiming other things make them sick when there are no evidence at all that it does cause them illness.

So, what's the real deal? Does it cause illness?

There's a good research done in 2006 by some French scientists, and they found no evidence that the wind turbines effect the health of the people living near it. The document and supporting evidence can be found on the The Reality Check's website here: The Reality Check Episode 46

Another thing is that if people didn't want the wind turbine to be situated near their homes, then every time they see or hear it will make them angry and frustrated. That's another part related to the nocebo effect.

Scientists say that if you are really bothered by it, then live at least 1.5 km away, so you won't be hearing the motor to remind you constantly.

Part 2:

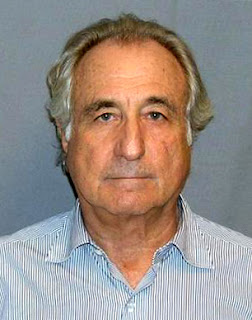

Benard Madoff, the self-confessed author of the biggest financial swindle in history, was sentenced to the maximum 150 years behind bars for what judge called an "extraordinarily evil" fraud that shook the nation's faith in its financial and legal systems and took "a staggering toll" on rich and poor alike.

What Madoff did was people gave him money, which he said he would invest somewhere, and when he earns money, both sides win. This is what investment brokers do.

So, the story began like this: Madoff owns a building with each of the floors managing the business in in their area. But, there's the 17th floor which no one is allowed into. Once, someone entered and saw a bunch of old computers running some sort of program in there, and the person asked other people why doesn't Madoff replace them. Other people just told him that Madoff takes care of that.

What Madoff was really doing was taking people's money and putting it into his own bank for his personal use. When people want to withdraw money, he can still give it to them. But, as long as the number of people withdrawing is less than the people investing, he'll have free money to use all the time.

That is what a Ponzi scheme is. It's a fraudulent investment operation that pays returns to separate investors from their own money or money paid by subsequent investors, rather than from any actual profit earned. The Ponzi scheme usually entices new investors by offering returns other investments cannot guarantee, in the form of short-term returns that are either abnormally high or unusually consistent.

Most of these investor brokers suddenly disappear. But Madoff was caught before he disappeared.

The Ponzi scheme was named after Charles Ponzi (March 3, 1882 - January 18, 1949) was an Italian swindler, who is considered one of the greatest swindlers in American history. The term "Ponzi scheme" is a widely known description of any scam that pays early investors returns from the investments of later investors. He promised clients a 50% profit within 45 days, which was way too much, that's why he got caught quite quickly.

Science Myth of the Week:

Do your fingernails keep growing after you die?

Of course not!

Part 2:

|

| Benard Madoff |

What Madoff did was people gave him money, which he said he would invest somewhere, and when he earns money, both sides win. This is what investment brokers do.

So, the story began like this: Madoff owns a building with each of the floors managing the business in in their area. But, there's the 17th floor which no one is allowed into. Once, someone entered and saw a bunch of old computers running some sort of program in there, and the person asked other people why doesn't Madoff replace them. Other people just told him that Madoff takes care of that.

What Madoff was really doing was taking people's money and putting it into his own bank for his personal use. When people want to withdraw money, he can still give it to them. But, as long as the number of people withdrawing is less than the people investing, he'll have free money to use all the time.

That is what a Ponzi scheme is. It's a fraudulent investment operation that pays returns to separate investors from their own money or money paid by subsequent investors, rather than from any actual profit earned. The Ponzi scheme usually entices new investors by offering returns other investments cannot guarantee, in the form of short-term returns that are either abnormally high or unusually consistent.

Most of these investor brokers suddenly disappear. But Madoff was caught before he disappeared.

The Ponzi scheme was named after Charles Ponzi (March 3, 1882 - January 18, 1949) was an Italian swindler, who is considered one of the greatest swindlers in American history. The term "Ponzi scheme" is a widely known description of any scam that pays early investors returns from the investments of later investors. He promised clients a 50% profit within 45 days, which was way too much, that's why he got caught quite quickly.

Science Myth of the Week:

Do your fingernails keep growing after you die?

Of course not!

No comments:

Post a Comment